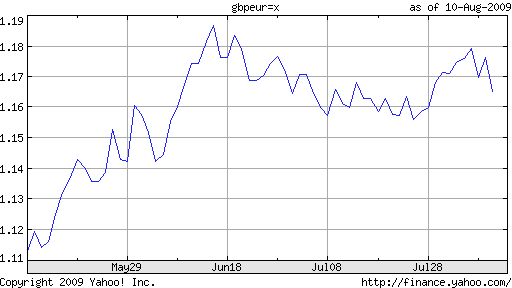

The British Pound’s rise since the beginning of March has been nothing short of spectacular: “Improving economic data have helped the pound advance 14 percent against the dollar this year and 12 percent against the euro.” Due primarily to a recovery in risk appetite and the concomitant belief that the Pound had been oversold following the onset of the credit crisis, investors began pouring hot money back into the UK. As recently as two weeks ago, one analyst intoned that, “Longer term, we are in part of an uptrend for the pound. I don’t think this is over.”

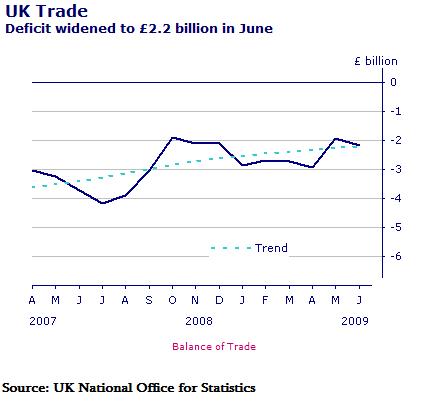

Since then, however, a series of negative developments have cast doubt on such optimism. The first was the release of economic data, which indicated an unexpected widening in Britain’s trade deficit. While exports rose, imports rose even faster, causing analysts to wonder whether it would be realistic to expect the British economic recovery would be led by exports: “We remain skeptical that the U.K. is about to become an export-driven economy any time soon. A return to sustained growth continues to look unlikely in the near term,” said one economist.

The second development was the decision by the Bank of England to expand its quantitative easing program: “The central bank spent 125 billion pounds since March as part of the asset-purchase program and had permission to use as much as 150 billion pounds, about 10 percent of Britain’s gross domestic product. Chancellor of the Exchequer Alistair Darling has now authorized an extra 25 billion pounds.” This came as a huge shock to investors, which had collectively assumed that the program had already been concluded.

Upon closer analysis, it appears that the rise of the Pound and the expanding trade deficit might have contributed to the BOE’s decision: “According to the Bank’s rule of thumb, this [the Pound's rise] is equivalent to interest rate increases of 1.5 percentage points.” However, interest rates are already close to zero. The BOE has already conveyed its intention to maintain an easy monetary policy for the near-term (March 2010 interest rate futures reflect an expectation for a 75 basis point rate hike); otherwise, there is nothing else it could do on the interest rate front. “Unless the UK is ready to deflate its production costs heavily, it can only achieve required competitiveness by reducing the value of sterling…The BoE knows this and its decision to increase its quantitative easing efforts may well have to be seen in the context of summer sterling strength.”

The final factor has been the Dollar’s sudden reversal. Previously, the Pound had been helped as much by UK optimism as by Dollar pessimism. This changed last week, when positive US economic data triggered expectations of a near-term economic recovery and consequent Fed rate hikes. In short, the Pound must now rest on its own two feet, and can no longer count on Dollar pessimism for a boost: “The current gloomy sentiment, which has chipped some 3% off sterling’s value against the dollar in the past four trading days, represents a sharp turnaround.”

The prognosis for UK economic recovery should receive some clarity tomorrow, when the Bank of England releases a report on inflation and GDP. At this point, we will have a better idea as to what to expect from the Pound going forward.

No comments:

Post a Comment