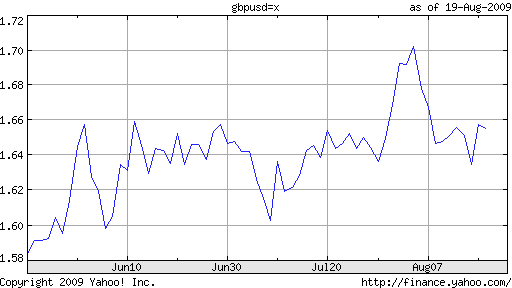

From trough to peak (March 10 – August 5), the British Pound appreciated by a whopping 25%, its strongest performance in such a short time period since 1985. The Pound has fallen mightily since then, and most factors point to a continued decline.

On almost every front, the Pound is being buried under a mound of bad news. Its economy is currently one of the weakest in the world, especially compared to other industrialized countries; on a quarterly basis, its economy is contracting at the fastest rate in over 60 years. Forecasts for UK economic growth are commensurately dismal: “Median estimates in Bloomberg economist surveys see the U.S. shrinking 2.6 percent in 2009 and expanding 2.2 percent in 2010, compared with a 4.1 percent contraction followed by 0.9 percent growth in the U.K.”

In addition, the only signs of growth appear to be a direct result of government spending, a notion that is evidenced by the latest retail sales and housing market data, both of which remain at depressed levels. “People are worried that the global recovery is based on unsustainable government spending and numbers like this from the U.K. only encourage those fears,” said one analyst in response.

While government spending, meanwhile, is arguably a valuable tool for stimulating economic growth, analysts worry that it might be reaching the limits of feasibility. “The Office for National Statistics said the budget shortfall was 8 billion pounds ($13.2 billion), the largest for July since records began in 1993.” On an annual basis, the government is planning to issue 220 Billion Pounds in new debt, to fund a budget deficit currently projected at 12.4% of GDP, easily the largest since World War II.

The Bank of England’s prescription for the country’s economic woes are also provoking a backlash. When the Bank announced at its last monetary policy meeting that it would expand its quantitative easing program by 50 Billion Pounds, the markets were aghast. Imagine investor shock, when the minutes from that meeting were released last week, revealing that 3 dissenting governors were agitating for an even bigger outlay! No less than Mervyn King, the head of the bank, “push[ed] to expand the central bank’s bond-purchase program to 200 billion pounds ($329 billion).

Given the dovishness that this implies, combined with an inflation rate that is rapidly approaching 0%, investors have rightfully concluded that the Bank is nowhere near ready to raise interest rates. “The market was expecting the BOE to be one of the first to hike rates. It’s becoming clear that’s unlikely, undermining the pound,” conceded one economist. Interest rate futures reflect an expectation that the Bank will hold rates at least until next spring. LIBOR rates, meanwhile, just touched a record low.

As a result, forecasts and bets on the Pound’s decline now seem to be the rule. “BNP Paribas…predicted another 9.3 percent decline to $1.50 in 12 months…After the Bank of England decision, pound futures and options speculators became more pessimistic as weekly bets favoring sterling fell more than 32 percent, the most since November.” In short, “Sterling is over-priced at current levels.”

No comments:

Post a Comment