As reported today by the Mortgage Calculator and other sources, the US housing market could be in the early stages of recovery. “Nationwide, home resales in June are up 9 percent from January, on a seasonally adjusted basis. Sales of new homes have climbed 17 percent during the same period. And construction, while still anemic, has risen almost 20 percent since the beginning of the year. Even home prices, down one third from the top, edged up in May, the first monthly increase since June 2006.” While the data is certainly susceptible to overly optimistic interpretation, these represent positive developments by any standard.

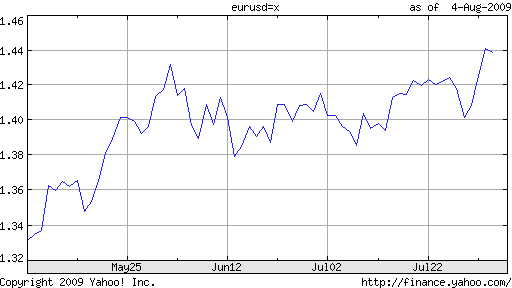

Before I lose the forex traders out there who probably think that they logged on to a housing blog by mistake, I’d like to point out that the release of this data coincided with a marked decline in the value of the Dollar, which “hovered near its 2009 low against the euro on Tuesday as a surprisingly strong U.S. housing report suggested the recession was waning.” This sound-byte encapsulates two important relationships: between forex and housing, and between housing and the economy. The former is indirect, while the latter represents a direct connection.

In a vacuum, forex traders probably couldn’t care less about housing data. Between interest rates, economic performance, geopolitics, risk appetite, financial markets, there is enough fodder to overwhelm most amateur analysts. Housing, then, is only important insofar as it bears on one of these “primary” forex factors. However, given the increasing role of housing in the US economy, perhaps it should itself be elevated to the top tier.

Let me explain: when the positive housing data was released last week, financial markets rallied, led by a “4.5% leap in the Dow Jones U.S. Home Construction Total Stock Market Index.” This immediately carried over into forex markets, as investors sold the Dollar en masse. “The market was desperate looking for direction, and a number like this is giving the market a small lift,” offered one analyst.

“The dollar remains vulnerable to good economic news,” summarized another. At face value, it might seem somewhat ironic that the Dollar is now inversely related to US economic performance. From the collective standpoint of investors, the US economic recovery is simultaneously indicative of and less interesting than a global recovery, and an improved environment for risk-taking. This tends to manifest itself in the form of a shift of funds away from safe-haven currencies is riskiery alternatives. In short, pay attention to the US housing market (data); the Dollar hangs in the balance.

No comments:

Post a Comment