Friday, October 2, 2009

Eur/Usd technical perspective

Starting the day

Hi everybody, and welcome back! I have a terrible cold these days, part because of a sudden return of winter to Buenos Aires, part maybe because I’m a bit over excited on coming to the ITC! Really for me will be a hell of an experience also, travelling alone, away from my girls. They are still too young, I had travelled in the past, not since I become a mom. Life changes a lot! Anyway, forex! forex! not me! As we talk last night in the Daily Wrap Up Webinar, here at FXstreet.com at 22:30 GMT, gold remains the forex market leader. Where gold goes, there goes dollar. Back above $1000/oz, rising almost 10 dollars in the last 24 hours, and dragging greenback down across the board. Data around the world since past Asian session has been quite positive, except maybe for Europe inflation readings, supporting greenback falling trend. But don’t you there to talk about deflation in the euro zone ok? Anyway, we have GDP and ADP in the U.S. in a couple of hours, so market will wait also for that, to see where are we heading from here. Here is the link for today’s calendar:

Majors’s sentiment for today

Here is majors sentiment for today:

Eur/Usd: Bearish

Gbp/Usd: Bearish

Usd/Chf: Bullish

Usd/Jpy: Bearish

Eur/Gbp: Bullish

Starting the day

Hi everybody and welcome! Monday again, and some risk aversion is seen since early Asian opening, with stocks down, losing some key level we are going to see in a few minutes, and gold contained under $ 1000/oz. Majors seem to have find a top against greenback, and movements are developing with different strength across the board. Mostly consolidating this morning, Yen strength, that reached the 88.20 zone early Asia, also points for more risk related movements. The currency has rose strongly against major rivals, reaching multi months lows, and rebounded quite strongly from there. Still not bottom seem at this point. Anyway, here is the link for today’s calendar:

EUR/USD weekly charts

Monday, September 7, 2009

Weekly Trading Update - August 31 - September 04 2009

Well thankfully it's been a much more profitable week this week after two winning trades on the EUR/GBP and GBP/USD pairs. There was also an opportunity to trade the EUR/USD pair as well this week but despite the daily Supertrend indicating a bullish trend, I'm reluctant to go long at the moment because I think this pair's heading lower in the next week or so. Plus there's been a lot of sideways action on this pair recently which is enough to put me off.

Anyway back to my trading results for this week and the first trade was on the GBP/USD pair on Tuesday afternoon. I had been waiting for this pair to break downwards and it do so convincingly during one 4-hour period. So as a result of the EMAs crossing downwards I entered on a pull-back at exactly 1.6250.

Thankfully the price continued downwards and I closed half the position for 50 points and let the other half run, moving my stop loss down to break-even. Later on the price had moved down to around 1.6125 so as it was getting late I moved my stop loss to 1.6150 and my target price to 1.6050 and let it run overnight. Sadly the stop loss was the one that got triggered but it was still a decent enough profit.

Incidentally the GBP/USD pair looks as if it may be about to cross downwards before the day is out, but I'm hoping it will hold on until next week because these crossovers often have much more momentum behind them at the start of the trading week.

The other trade was on the EUR/GBP pair and if you've been reading my blog this week you will know all about this trade already because I discussed it in some detail in this blog post. As I mentioned at the time this was a low-risk high-reward trade, and thankfully the 30 point stop loss wasn't triggered and I managed to bank a healthy profit of 74 points.

It has actually dropped another 40 points since then but I was so bored watching this pair that I closed out the position shortly after it hit my initial price target.

Nevertheless it's been a profitable enough week on the whole.

(If you would like to find out more about my main 4 hour trading strategy, you can access it for free when you subscribe to my newsletter. Simply fill in the short form above).

Why Do So Many Forex Traders End Up Losing Money?

A lot of people have jumped on the forex trading bandwagon in recent years. They've heard about how much money you can potentially make by trading the currency markets and have leapt head-first into this exciting industry.

However once they open an account and start trading, they soon realise how difficult it is. Indeed the vast majority of people will end up losing money. So where do they go wrong?

Well firstly they will often start trading without using a proven trading system, ie a system that has generated profits consistently on a long-term basis. The systems that they do use are often sub-standard ones they have bought on the internet or read about on the various forex forums.

They may even choose to use a forex robot if they don't fancy trading the markets themselves. However again while there are some profitable expert advisors, many of them will end up losing money in the long run.

The other major problem is most people new to forex trading do not have a firm grasp of money management, and more specifically how to manage risk. As a result they will often overexpose themselves when they enter a position which will eventually lead to them being completely wiped out in a lot of cases.

Well anyway if you yourself have trouble understanding risk management, then you may like to know that Bill Poulos has just released a new training video which covers this particular subject.

In this video he reveals the #1 reason why so many traders lose money and remedies this by providing you with the perfect risk/reward ratio that you can use as part of your trading plan. He also shows you how you can eliminate risk from every single trade you make.

You can watch this video by clicking here.

The EUR/GBP Pair - An Excellent Shorting Opportunity Above 0.88?

I've been watching the EUR/GBP pair very closely this week. Since dropping below 0.85 last month it's been steadily climbing upwards and in recent days it's been hovering just above the 0.88 level. However there are signs starting to emerge that this pair could be about to turn downwards.

If you look at the 4 hour chart for this pair and draw the Supertrend indicator you can see that although it's green, it has flattened out a lot, which is always a good indication that the bullish trend is running out of momentum.

Furthermore you can also see that the price has so far posted three recent highs of 0.8839, 0.8835 and 0.8833. Therefore it's clear that this pair is clearly struggling to breakout and post new highs.

This is why I personally believe that there is an excellent low-risk high-reward trading opportunity available on the EUR/GBP pair at the moment.

Indeed I opened a short position earlier this morning at 0.8820 and believe it could work out very nicely. I have placed my stop loss roughly 10 points above the highest high at 0.8850 in case the price does eventually break upwards, but I intend closing the position at somewhere between 0.87 and 0.8750 (I haven't decided yet).

The way I see it is that I'm perfectly prepared to risk a small 30 point loss in order to potentially make 70-120 points.

Let's see how it turns out.

(UPDATE: You could die of boredom watching this pair but thankfully I've finally managed to close this position at 0.8746 after it finally dipped below 0.8750. So this was a decent enough profit in the end).

Weekly Trading Update - 24-28 August 2009

Well it's been another frustrating week with a lot of sideways trading action but the summer months are coming to an end now so hopefully things will pick up in the next few months. There were just two trades this week using my main 4 hour trading strategy. They were both winners but I don't think I'll be ordering the yacht just yet.

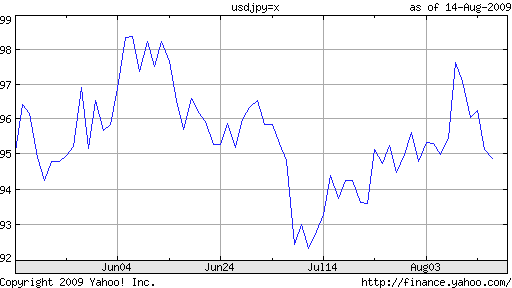

The trades in question were on the GBP/USD and USD/JPY pairs. Both of these were in bearish trends on the daily chart (according to the Supertrend indicator) so I was only looking for shorting opportunities on the 4 hour charts.

The first trade occurred on Monday afternoon when the EMAs crossed decisively downwards on the GBP/USD pair. I went short at 1.6432 and ended up holding on to it overnight. My initial target price of 50 points was achieved the following morning and after closing out half the position I let the other half run, moving my stop loss down to break-even.

I had to go out on Tuesday afternoon so I set my target price at 1.6230 because I really believed a 200 point profit was easily achievable on this latest downwards move. However I was incredibly frustrated to come back and find that it had taken out my stop loss at break-even. Worst still the price did then go on to fall to this level (and indeed all the way to 1.6154). So it's fair to say that I was not amused.

The USD/JPY trade occurred on Tuesday morning after the EMAs crossed downwards. I went short at 94.27 but wasn't particularly confident about this one. Because I was going out I set both my stop loss and my target price at 40 points. Thankfully it did reach this target in the end but I was very close to being stopped out on two separate occasions.

So overall a steady but unspectacular week. By the way just like last week there has been an upwards EMA crossover on the EUR/USD pair but the decisive crossover candle was again too long for my liking.

If you would like to receive full details of my main 4 hour trading strategy, you can access it for free when you subscribe to my newsletter. Simply fill in the short form above.

Fibonacci Analysis and Forex Trading: A Match Made In Heaven

I've got something a little different for you today because the article below is a guest article from John Robinson (forextraders.com). It's a detailed article about fibonacci analysis and how you can incorporate it into your forex trading. I don't discuss this subject very often on this blog so hopefully you will find it useful.

Who knew that a mathematical theory developed sometime in the 13th century would have so many applications today? Leonardo Fibonacci, the Italian mathematician for whom the Fibonacci theory is named lived between 1175 and 1250, but his theory lives on today. In fact, Fibonacci is one of the most often used technical analysis tools by traders of all asset classes, but its applications when it comes to forex analysis are especially useful.

Understanding the Fibonacci theory is easy. It states that each term in a sequence of numbers is the sum of the previous two numbers. (1,1, 2, 3, 5, 8 and so on.) The sequence isn't all that important to understanding Fibonacci for forex analysis, but the power of the so-called Golden Ratio is. The Golden Ratio is basically the quotient of the adjacent terms and that number is 1.618 or 0.618 as an inverse. How important is this number? Just type Fibonacci 1.618 into a search engine and watch how many results turn up that involve the practical application of this number.

But enough with that. How can Fibonacci be used to make a forex trading strategy more profitable? Used in forex analysis, Fibonacci's golden ratio is translated to three numbers 38.2%, 50%, and 61.8%. Five lines are drawn on a chart including these three numbers with 100% and zero percent. Obviously, 100% is the high and zero percent is the low.

The interesting thing about the Fibonacci levels on a forex chart is that they frequently act as places where prices start to rebound or as support and resistance levels. On a traditional five-line Fibonacci chart, a currency pair that has retreated from the 100% line is likely to find support at the 61.8% line. If the pair doesn't find support there, that is a signal for to sell it short. Knowing this, it's fair to say the Fibonacci theory is a useful tool for trend traders.

On the other hand, Fibonacci can also be a profitable tool for short term trading. If scalping is part of your forex trading strategy, then you should not be without Fibonacci charts on your trading platform. As we said above, Fibonacci levels often represent price areas where a forex pair starts to rebound, so using the example above of currency that has peeled back from the 100% Fibonacci line, it is likely to find support at the 61.8% line and start to move higher again. If you take a look at a long-term chart, say an hourly or daily, and draw Fibonacci lines, you're bound to see several examples of the Fibonacci lines acting as areas where a previous price trend started to reverse.

The point is that short-term traders are often getting thrown around by market movements because they don't properly identify the most important price levels in a given forex pair. Proper use of Fibonacci lines can help prevent this problem and put the odds in favor of the forex trader. And no, you won't need to draw the lines yourself by hand. Most charting packages come with a Fibonacci feature.

Smart forex traders know that trading against the trend is perilous to the health of their account and that their forex analysis regimen needs to include trend identification. Fibonacci is a superior tool for keeping a forex trading strategy on the right side of the trend.

Forex Volume is Down – What are the Implications?

According to a recent report by the Reserve Bank of Australia (RBA), forex volume is down in nearly every major category. “However, turnover declined by over 20 per cent between October 2008 and April 2009 to US$2.5 trillion, to be at its lowest level in over two years, a move reflected in all six markets indicating global, rather than location-specific, causes. The largest markets – the United Kingdom and the United States – experienced the sharpest percentage falls.”

The report was based on a survey of the world’s six largest forex trading hubs – US, UK, Japan, Canada, Singapore, and Australia – and produced a few interesting revelations. The first is that forex volume peaked well after other capital markets. This can probably be attributed to the notion that there is never a bear market in forex. In other words, after stocks and bonds began to collapse in the summer of 2008, investors embarked on a mission, unprecedented in its speed, to move capital from risky countries to safe-haven countries. This switch, by definition, required the forex markets to facilitate.

This point is further illustrated by the fact that, “the decline in turnover of spot and forwards occurred somewhat later than that in foreign exchange swaps and derivatives….Spot turnover reported in October 2008 was likely to have been supported by large cross-border capital flows as investors sought to reduce risk by repatriating foreign investments. In addition, the high frequency and impact of news at the height of the crisis would have generated the need for investors to frequently adjust their positions.”

The final revelation is that the change in forex volume was not always commensurate with changes in trade volume. A general relationship between trade and forex turnover has been observed, although speculators ensure that currency is exchanged much more frequently than actual goods and services. The two currency pairs registering the greatest unbalance are the CHF/USD and CAD/USD. Forex volume for the former fell much more sharply than trade, while the opposite is true of the latter. One can only speculate as to why this is the case. As for the CHF/USD, forex volume probably suffered disproportionately more because both the Swiss Franc and US Dollar were perceived as safe haven currencies, in which case it would be relatively less useful to exchange them for each other. In the case of the CAD/USD, meanwhile, it makes sense to view the imbalance in terms of the spectacular decline in trade, which was largely a product of declining commodity prices.

It’s impossible to predict whether forex volume will remain depressed. Given the efforts underway to increase regulation and curtail leverage, I don’t personally expect volume to recover for a while. As for the implications, the less might be to stick to the majors. If volume is declining, it will probably affect emerging market currencies most. Lower liquidity might translate into higher volatility. However, it’s worth pointing out that volatility has been declining ever since it skyrocketed after the collapse of Lehman Brothers last fall. In that case, it might be that investors are behaving more prudently with less funds to trade with.

Forex Markets Indifferent to Bernanke Nomination

Earlier this week, President Obama officially nominated Ben Bernanke to a second four-year term as Chairman of the Federal Reserve Bank’s Board of Governors. The reaction was relatively muted, perhaps because most pundits had already anticipated the news. Bernanke himself probably sealed his own re-appointment with the public relations campaign he embarked on last month, ostensibly to offer a rationale for his response to the credit crisis. “In a profound departure from the central bank’s tradition as an aloof and secretive temple of economic policy, Mr. Bernanke has plunged into the public spotlight to an extent that none of his predecessors would have contemplated.”

Most of the sound-byte reactions came from politicians, and focused on whether he deserved another term, rather than the potential ramifications of his re-nomination. Heavyweights Barney Frank and Christopher Dodd both offered tepid support. Ron Paul referred to the news as irrelevant. Meanwhile, “European Central Bank President Jean-Claude Trichet on Tuesday said he was ‘extremely pleased’ by President Barack Obama’s decision.”

The reactions from investors, likewise, ranged from ambivalent to moderately supportive. Equity markets rose to a 2009 high the day after the story broke, while the Dollar fell slightly. The re-appointment was deliberately awarded five months ahead of schedule in order to help the president’s credibility with investors. Fortunately (or unfortunately, depending on how you look it), the fact that the markets didn’t react much, shows that they don’t really care. In other words, “President Obama overstated matters when he said that Mr. Bernanke had kept us out of a Great Depression” not only because “this remains to be seen,” but also because the ebbs and flows of GDP are contingent on more than just monetary policy.

Regardless of how much credit Bernanke actually deserves, he will certainly have his work cut out for him in his second term. “Bernanke’s Next Tasks Will Be Undoing His First,” encapsulated one headline. At some point, the Fed must raise interest rates, return credit markets to normal functioning, and remove hundreds of billion of dollars from the money supply.

But this is easier said than done: “If the Fed shifts too quickly from the role of savior to that of strict disciplinarian, it risks aborting the recovery and tipping the nation back into a recession, essentially repeating mistakes made in 1937 after the economy had begun to rebound. If the Fed moves too slowly, it risks the kind of intractable inflation it experienced in the 1970s and fueling another bubble.”

The consensus is that, for better or worse, he will err on the side of price stability, perhaps at the expense of economic growth. “A Fed chaired by Ben Bernanke will follow a policy uncomfortably tight as the 2012 election looms into sight. Bernanke has espoused a commitment to low inflation over his entire career,” argued one economist. Meanwhile, the markets aren’t expecting rate hikes at least until 2010, although Bernanke, himself, has conveyed a sense of optimism – and hence hawkishness – about a quick exit from recession.

What does all of this mean for the Dollar? It’s impossible to say exactly, and depends largely on whether Bernanke can unwind the easy money policy of the last year just as deftly as he deployed it.And of course, there is the wild card of the US National debt, and the potential for a loss of confidence to induce a run on the Dollar, which even Bernanke would be powerless to solve.

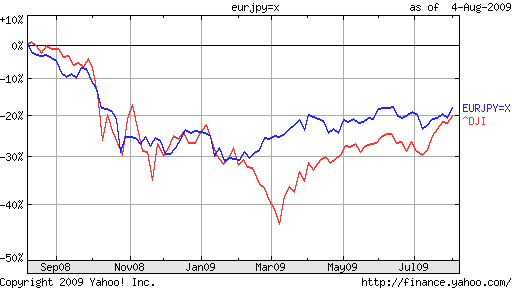

Carry Trade Still Popular, but Doubt is Growing

It’s safe to say that the inverse correlation observed between the Dollar (and also the Yen) and global equities is largely a product of the carry trade. “The U.S. stock market bottomed and the U.S. Dollar Index peaked almost simultaneously in March. While U.S. stocks are up more than 50% in that time, the Dollar Index (which measures the greenback’s value against the euro, the yen, the British pound, the Canadian dollar, the Swedish kroner and the Swiss franc) is down nearly 12%,” observed one analyst.

On one level, this represents a return to 2008, prior to the explosion of the credit crisis, when carry trading was THE dominant theme in forex markets. However, there is one important difference. While the Dollar and Yen were the funding currencies then and now (due to their low interest rates), there has been a slight shift in the currencies selected for the opposing/long end of the trade.

Traditionally, the most popular long currencies were those of industrialized countries, rich in commodities and backed by high interest rates and often rich in commodities. To be sure, these currencies have shined in recent months, certainly due in part to speculative (carry) trading. “Strategists at Wells Fargo Bank in New York ‘believe that the gains in the dollar-bloc currencies (Australia, New Zealand, Canada) have run ahead of the gains in commodity prices.’ ” The Bank of Canada also noticed that “At the time of its last statement, oil prices were about $75 a barrel, but now they are in the $60-to-$65 range. That suggests the currency’s appreciation has outpaced the demand for its commodity exports.”

But the run-ups in the Kiwi, Aussie, and Loonie have been overshadowed by even more rapid appreciation in emerging market currencies. This shift is largely a product of changes in interest rate differentials, which are now gapingly large between developed countries and developing countries. Compare the 2.75%+ spread between the US and Australia, with the 8.5% spread between the US and Brazil or 12.75% between the US and Russia. For investors once again becoming complacent about risk, the choice is a no-brainer.

Still, some analysts are nervous about this change in dynamic: “While the new carry trade may be less leveraged, it’s an inherently riskier bet. As such, it’s more vulnerable to the kind of swift unraveling of risk appetite observed across all nations and sectors in 2008, but which occurs with far more frequency in emerging markets.” Meanwhile, emerging market stocks have behaved volatilely over the last few weeks (with Chinese stocks even entering bear market territory), and some investors are concerned that they may be temporarily peaking. There are also signs that bubbles may be forming in carry trade currencies, with bullish sentiment at high levels. Accordingly, one strategist suggests waiting out a 5% pullback in the Australian dollar, and a 10% pullback in the New Zealand dollar before going back in.

There is also the outside possibility that the Fed will raise interest rates, which would crimp the viability of the US Dollar as a funding currency. Granted, it seems unlikely that the Fed will tighten within the next six months, but investors with a longer time horizon could begin to adjust their positions now, rather than wait until the 11th hour, at which point everyone will be rushing for the exits.

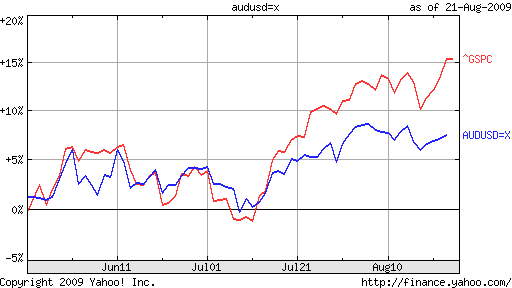

Australian Dollar Rises, Remains Closely Correlated with Stocks

The performance of the Australian Dollar over the last six months has been nothing short of incredible: “Since the end of February, the Australian dollar has risen 29% against the U.S. currency,” and a still-impressive 18% if you backtrack to January, when the Aussie was still in free-fall.

As has been the trend in forex markets of late, the currency’s rise cannot be attributed to an improvement in fundamentals. The economic picture remains nuanced (that is putting a positive spin on it), and definitive proof of recovery has yet to emerge. “We really are trawling pretty deep to try and get any snippet of information that might have some backhanded relevance as far as Australia goes,” said one analyst.

As a result, fundamental analysts have been forced to wait for a “more precise picture about the timing [of] any Reserve Bank of Australia interest rate hike.” On this front, investors are ratcheting down their expectations of a rate hike anytime soon, as “The RBA has signaled that there’s a danger of raising rates too soon.” Futures prices reflect the expectation that rates will rise by only 37 basis points from current levels before 2010, and by 161 basis points 12 months from now.

With such economic uncertainty, investors have turned their attention elsewhere. “Nomura Chief economist Stephen Roberts said in the absence of any clues about the fundamental drivers of the currency, nearly all the cues in foreign exchange markets are being taken from equities.” Some analysts have posited a close relationship with the US stock market: “The correlation between the Aussie dollar and U.S. equity market in particular has been very strong over the past few weeks, with our analysis showing a correlation as high as 95 percent.”

For other analysts, the relationship is with the Chinese stock market. This correlation makes more sense logically, since the Australian economic recovery is largely contingent on continued growth in China and the concomitant purchases of Australian commodities. “Currency markets will be watching the Shanghai share market, which has been a pretty big influence on the Aussie recently,” summarized one analyst. A reporter for the WSJ tried to spell it out even more clearly in an article entitled, “Australian Dollar Up Late, Closely Tied To Chinese Stocks.”

Unfortunately, the correlation with (Chinese) stocks runs both ways. When the Chinese stock market tanks – often for inexplicable reasons – as it has for the last three weeks, the Australian Dollar follows suit. Another analyst is more blunt: “The story for the Australian dollar and other risk- and growth-oriented currencies is similar to the share markets. They’ve had a great run and are probably due a bit of a pullback.”

Dollar Reverts Back to Former Self

Only two weeks ago, analysts were singing about a new day for the Dollar, which had risen on the basis of good news for the first time in months. In hindsight, it looks like such talk was premature, as the Dollar has returned to its old ways. Good news once again causes the Greenback to fall, while bad news causes it to rise.

This development (or lack thereof) suggests that investors may have gotten ahead of themselves, when they sent the Dollar surging after the employment picture brightened slightly. At the time, the news was interpreted as a sign that rate hikes were imminent. On a broader level, it was a sign that investors had dumped the paradigm of risk aversion, in favor of a model based on comparing economic fundamentals. Since then, investors have slowly moved to distance themselves from the notion that the Fed will soon hike rates, and in the process have moved back towards trading based on risk dynamics.

As a result, positive news developments over the last couple weeks have coincided both with a rise in equity prices and a decline in the Dollar. When the Chinese stock market collapsed one day last week, investors responded by dumping high-yield assets, and moving temporarily back into “safe haven” currencies. “Diving Shanghai Helps Dollar” read one headline. “Worries over the continued fragility of the world economy outweighed a firmer tone in overseas equity markets to underpin the U.S. dollar versus major counterparts,” explained another report.

Meanwhile, a divide is forming among fundamental analysts. There is one school of thought which argues that the US will be the first industrialized economy to recover, and hence the first to raise rates. Based on this line of reasoning, then, positive economic news provides a foundation upon which to buy the Dollar. A competing school of thought, meanwhile, has suggested that regardless of if/when a US recovery materializes, it will be overshadowed by out-of-control inflation. In this regard, then, the Dollar is not such an attractive buy.

No less than the venerable Warren Buff has insisted that the Fed’s quantitative easing program and the US economic stimulus plan – while necessary – threaten to create even bigger problems than the ones they purport to solve. “But enormous dosages of monetary medicine continue to be administered and, before long, we will need to deal with their side effects. For now, most of those effects are invisible and could indeed remain latent for a long time. Still, their threat may be as ominous as that posed by the financial crisis itself,” he said.

If this true, then the Dollar is damned either way. Damned in the short-term as a result of a pickup in risk appetite, and damned in the long-term due to inflation.

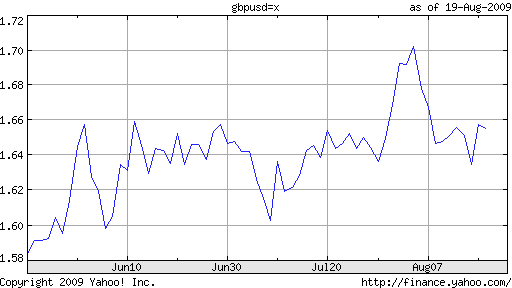

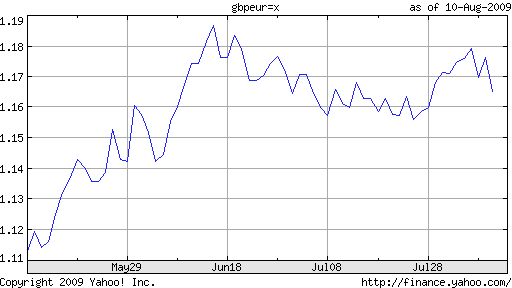

Record Rise in British Pound comes to an End

From trough to peak (March 10 – August 5), the British Pound appreciated by a whopping 25%, its strongest performance in such a short time period since 1985. The Pound has fallen mightily since then, and most factors point to a continued decline.

On almost every front, the Pound is being buried under a mound of bad news. Its economy is currently one of the weakest in the world, especially compared to other industrialized countries; on a quarterly basis, its economy is contracting at the fastest rate in over 60 years. Forecasts for UK economic growth are commensurately dismal: “Median estimates in Bloomberg economist surveys see the U.S. shrinking 2.6 percent in 2009 and expanding 2.2 percent in 2010, compared with a 4.1 percent contraction followed by 0.9 percent growth in the U.K.”

In addition, the only signs of growth appear to be a direct result of government spending, a notion that is evidenced by the latest retail sales and housing market data, both of which remain at depressed levels. “People are worried that the global recovery is based on unsustainable government spending and numbers like this from the U.K. only encourage those fears,” said one analyst in response.

While government spending, meanwhile, is arguably a valuable tool for stimulating economic growth, analysts worry that it might be reaching the limits of feasibility. “The Office for National Statistics said the budget shortfall was 8 billion pounds ($13.2 billion), the largest for July since records began in 1993.” On an annual basis, the government is planning to issue 220 Billion Pounds in new debt, to fund a budget deficit currently projected at 12.4% of GDP, easily the largest since World War II.

The Bank of England’s prescription for the country’s economic woes are also provoking a backlash. When the Bank announced at its last monetary policy meeting that it would expand its quantitative easing program by 50 Billion Pounds, the markets were aghast. Imagine investor shock, when the minutes from that meeting were released last week, revealing that 3 dissenting governors were agitating for an even bigger outlay! No less than Mervyn King, the head of the bank, “push[ed] to expand the central bank’s bond-purchase program to 200 billion pounds ($329 billion).

Given the dovishness that this implies, combined with an inflation rate that is rapidly approaching 0%, investors have rightfully concluded that the Bank is nowhere near ready to raise interest rates. “The market was expecting the BOE to be one of the first to hike rates. It’s becoming clear that’s unlikely, undermining the pound,” conceded one economist. Interest rate futures reflect an expectation that the Bank will hold rates at least until next spring. LIBOR rates, meanwhile, just touched a record low.

As a result, forecasts and bets on the Pound’s decline now seem to be the rule. “BNP Paribas…predicted another 9.3 percent decline to $1.50 in 12 months…After the Bank of England decision, pound futures and options speculators became more pessimistic as weekly bets favoring sterling fell more than 32 percent, the most since November.” In short, “Sterling is over-priced at current levels.”

All Eyes on Central Banks

While Central Banks have always featured heavily in the minds of forex traders, their actions have taken on a whole new significance of late. Financial reporters have also been generous in doling out space to stories about Central Banks, writing stories with headlines like “Central bankers add to equities’ momentum” and “Currency Traders Hold Fire, Await Central Banks.”

Traditionally, forex traders eyed Central Banks for one reason: interest rates. The theory was simple: currencies with higher interest rates tended to outperform in the short term. This trend was especially reliable in the years leading up to the housing bubble, as carry traders ensured that high-yielding currencies rose while low-yielding currencies stagnated or fell.

Even in the context of the credit crisis, traders have continued to monitor the rate setting activities of Central Banks. Interest rates in every industrialized country are currently locked at record low levels, but anticipation is already starting to build that the beginning of a tightening cycle is just around the corner. Current expectations are for the US to lead the way (first to lower, first to rise), followed by Australia, New Zealand, and Canada. The Bank of England and European Central Bank are further away on the curve, while rate hikes are a remote possibility in Japan, a perennial favorite of carry traders.

Interest rates are now only a small part of the equation, however. Most Central Banks have implemented additional strategies, known variously as quantitative easing, asset purchases, liquidity programs, etc. The goal of all of these programs is to stimulate the money supply and stabilize financial markets, by injecting newly-minted money directly into capital markets. Traders initially focused on which Central Banks were involved in quantitative easing. After nearly every bank introduced some version, it quickly became a question of scope. In this respect, the Fed and the Bank of England are in first and second place, respectively. Now, traders are waiting to see not only when these programs will end, but also when they will be unwound. If there is a perception (and even worse, a reality) that some Central Banks are waiting too long to draw funds out of the market, this could foster (concerns of) inflation, and consequently, currency depreciation.

Finally, there is the issue of direct currency intervention. The Swiss National Bank became the first western bank to intervene on behalf of its currency. Its actions are directly responsible for holding the Swiss Franc down. The Bank of England meanwhile has used its quantitative easing program to influence the Pound, while the Banks of Korea and Brazil are buying Dollars on the spot market to depress their respective currencies. Paranoia is clearly running high, and some traders are apparently concerned that the Fed could be next. Just when you thought the surprises were over.

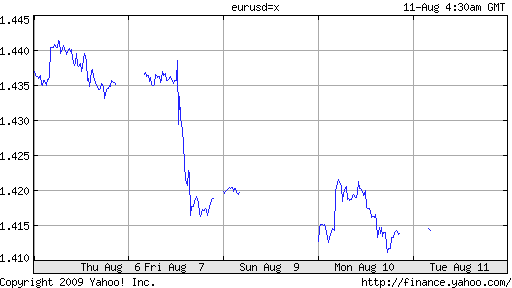

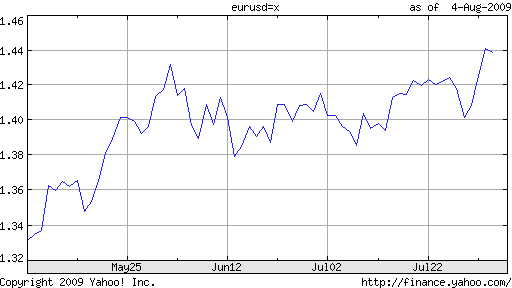

euro retreats from 2009 Highs

In forex, timing is everything. If I had written this post a couple weeks ago, the headline would read “Euro Touches 2009 High.” Perhaps if I had waited another week, it would have read, “Euro Approaching 2009 High.” But alas, I chose today to write about the Euro, and the headline I chose is probably the most appropriate under the circumstances.

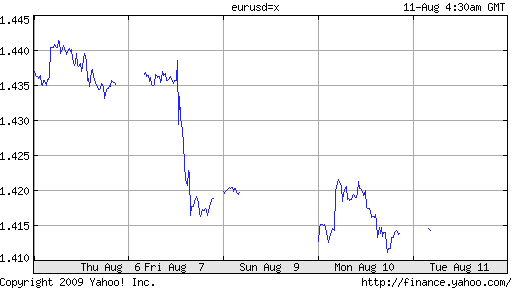

On August 5, “The euro hit a high for the year against the dollar as stocks trimmed their losses in afternoon trading Wednesday despite a generally cautious tone in currency markets.” Analysts were careful to point out that the markets remained cautious and the Euro eased past – rather than smashed through – its previous high. Technical analysts would and have argued that this paved the way for the subsequently rapid decline: “The euro is testing the base of an ascending channel with daily momentum charts showing a ‘double top in overbought territory.’ ”

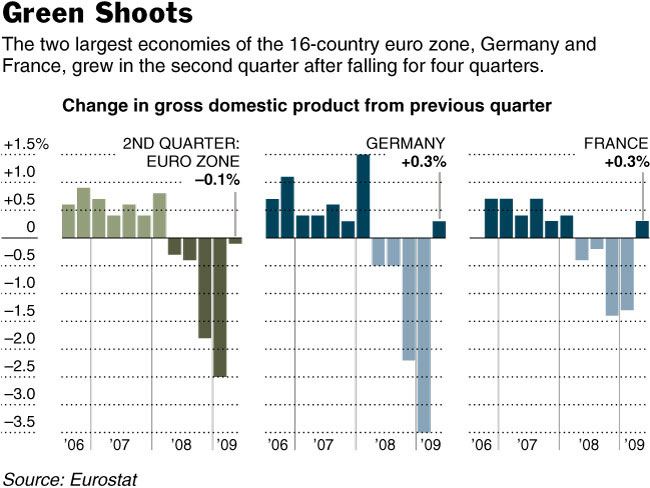

This notion might have some merit, considering that fundamentals arguably favor a continued Euro appreciation. “The economy of the 27-country European Union shrank 0.3 percent in the three months ended June 30, for an annual rate of roughly 1.2 percent. The 16 countries that use the euro registered a 0.1 percent decline for the second quarter, or an annual rate of roughly 0.4 percent.” While output remains well below its 2008 levels, the slight contraction represents a tremendous improvement from the first quarter, when GDP shrank by 2.5%.

“Underlying the strong reading were solid performances in France and Germany, each of which grew 0.3 percent in the second quarter, government data showed.” This is helping to offset further contractions in Italy and Spain, which have turned into economic laggards as a result of the housing bust. In addition, exports in Germany grew by 7% last month, and “Investor sentiment improved more than analysts had expected in August to its best level since April 2006.” On an aggregate basis, “the euro zone’s trade balance with the rest of the world rose to 4.6 billion euros ($6.5 billion) in June, compared to a flat balance in the same month last year,”

Still, explorers looking for bad news and/or cracks beneath the surface will have no difficulty finding them. German exports (and output in general remain down year-over-year. In addition, there are still trouble spots in the EU, notably in western Europe. “Already, the euro area’s unemployment rate stands at 9.4 percent, its highest level in 10 years, and the anemic growth of the coming quarters will not be enough to arrest the slide. That, in turn, could drag down consumer confidence or even generate political backlash in Europe, economists said.” Most worrying is perhaps that, “consumer prices in the euro area dropped 0.6 percent in July…” ‘Deflation is becoming entrenched in the euro area, which would be very bad for the economy.’ ” Good thing the ECB left some room to lower rates further.

The Force is With the Yen

Just when it looked like the carry trade was back for good and all signs pointed to a Yen depreciation, out of nowhere came a series of surprise developments, propping the Yen back up. Spanning finance, economics, and politics – a Forex Trifecta – these developments moved swiftly through the markets, creating optimism for the Yen where before there was only pessimism. Of course, it’s possible that this bump will prove temporary, and a reversal could transpire just as quickly.

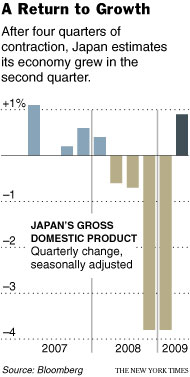

The biggest news, by a large margin, was a report that the Japanese economy had returned to growth. Similar in scale and in tenor to stories coming out of other countries, the data showed that Japan grew at an annualized rate of 3.6% in the second quarter of 2009, a sharp reversal from the 11.7% contraction in the previous quarter (which was itself revised upward from -14%).

The sudden sea change was brought about by a combination of government spending and export growth. “New tax breaks and incentives to help sales of energy-efficient cars and household appliances, coupled with lower gas prices and a rebound in share prices, spurred consumer spending. Prime Minister Taro Aso has pledged 25 trillion yen (about $263 billion) in stimulus money, including a cash handout plan and more public spending on programs like quake-proofing the country’s public schools, to revive the economy.” Meanwhile exports grew by a healthy 6.3% from the previous quarter, while imports fell, causing the trade surplus to widen.

The announcement of economic recovery was accompanied by a noteworthy reversal in capital flows, such that Japan’s capital account swung into surprise weekly surplus: “Foreign investors bought 292.9 billion yen ($3.1 billion) more Japanese stocks than they sold during the week ended Aug. 8 and domestic investors were net buyers of 125 billion yen in overseas bonds and notes.” Meanwhile, speculation is mounting that Japanese investors will move to repatriate some of the coupon and redemption payments they receive on their US Treasury investments.

While seemingly unrelated to the economic turnaround (it’s important not to read too much into weekly data), this could be a sign that Japanese investors are growing more optimistic about domestic economic prospects and are moving to invest more at home. It’s worth noting that such a shift could actually be necessary if the recovery is to be sustained, in order to increase the role of (capital) investment, relative to exports and government spending. Ironically, it could instead be a sign of excessive pessimism, if Japanese believe that prospects for US/global growth have been overestimated, in which case risk appetite and the carry trade would be due for a combined correction.

Domestic consumption could also play an increasing role in Japan’s economy going forward, as a result of imminent political changes. “To stimulate consumption at home, the Democrats have pledged to put more money in the hands of consumers by providing child allowances, eliminating highway tolls and making fuel cheaper. That marks a shift away from the long-ruling LDP’s emphasis on steps to help companies.”

Along similar lines, the Democratic Party (which has a wide lead over the incumbent Liberal Democratic Party), has also conveyed its opposition to currency intervention, since such tactics inherently prioritize export growth over domestic consumption. “Japan’s export-led growth is reaching its limits and Tokyo should not intervene in markets to weaken the yen as long as currency moves match fundamentals, the No.2 executive in the main opposition party said on Monday.” Could the carry trade be in trouble?

Brazil Real Edging Up, Despite Efforts of Central Bank

The Brazilian Real has been one of the world’s best performers in 2009, having risen by a solid 25%. The currency is now close to pre-credit crisis levels, and is even closing in on an 11-year high. When you consider that only six months ago, most analysts were painting doomsday scenarios and predicting currency devaluations and bond defaults for the entire continent, this is pretty incredible!

The currency’s rise has been supported by a variety of factors, few of which are grounded in fundamentals. To begin with, while Brazil has staved off depression, it’s not as if the economy is firmly back on solid footing. The economy contracted by 5% in the first quarter, and forecasts for 2009 GDP growth still vary widely, from a slight contraction to modest expansion. Meanwhile, the economy is importing more than it exports, despite the rebound in commodity prices. “The central bank said the net trade result was based on $9.89 billion in receipts for exports and $12.72 billion in import payments overseas.”

“Investment inflows, meanwhile, totaled $33.88 billion, while outflows totaled $29.78 billion.” The disparity between investment and trade data goes a long way towards explaining the Real’s rise. Thanks to a recovery in risk appetite, foreigners have poured cash into Brazil at an even faster rate than they once removed it. As a result, Brazil’s “Bovespa stock index has risen 51 percent this year, the world’s 12th-best performer among 89 measures tracked by Bloomberg, as foreign investors moved 13.7 billion reais into the market through July, the most since the exchange began tracking data in 1993. Brazilian local bonds returned 37 percent in dollar terms after falling 13.8 percent in 2008.” The country’s foreign exchange reserves also just set a new record, surging past the $200 Billion mark.

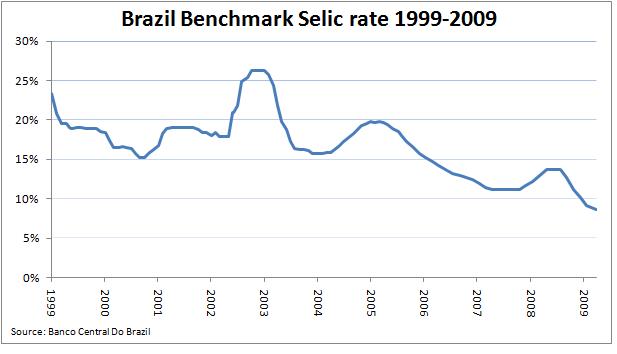

Brazilian interest rates tell the rest of the story. Despite a gradual decline over the last decade (made possible by a moderation in inflation), Brazil’s benchmark SELIC rate stands at a healthy 8.65%, which is the highest in South America, after Argentina. Unlike Argentina – and the dozen or so other economies around the world that boast equally lofty interest rates – Brazil is perceived as relatively safe place to invest. Given interest rate levels in the western world, combined with the expectation that Brazil’s currency will appreciate further, investors are more than happy to accept a little bit of risk in order to earn an out-sized return.

Just like the Bank of Korea, Bank of England (both profiled by the Forex Blog in the last week), the Bank of Brazil is not happy with the resilience in its currency. “Brazil’s central bank said on Wednesday it bought $779 million on the spot foreign exchange market this month to Aug. 7 as dollar inflows to the country surged because of growing demand for local stocks and bonds.” This brings the total intervention expenditure to $9 Billion.

Unfortunately for the Bank of Brazil, the forces in the forex market are way beyond its control. “Dollar inflows to the country totaled $2.26 billion this month to Aug. 7, compared with inflows of $1.27 billion in all of July.” Analysts are also unconvinced, and are racing to revise their Real forecasts upward. One economist, caught completely off guard, just “changed his year-end real forecast to 1.8 from 2.5 at the start of the year. ‘The resilience of the Brazilian economy to weather this crisis has been spectacular,’ ” he explained.

Korean Won Rebounds Strongly

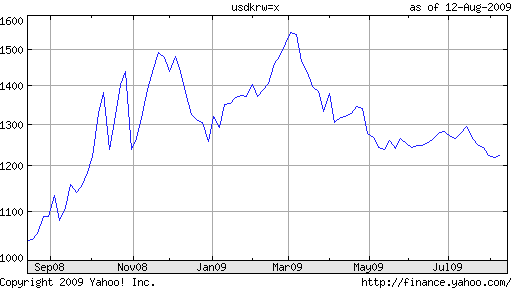

Last year the Korean Won was one of the world’s weakest currencies- and that’s saying a lot when you you consider how many currencies tanked at the onset of the credit crisis. The Won lost nearly half of its value, driven by concerns that Korean creditors would be unable to pay their foreign debts. Since March, however, the currency has rebounded by an impressive 25%, as the government took action: “To avert a crisis, South Korea forged a dollar-swap agreement with the U.S., pumped money into the banking system, boosted fiscal spending, set up funds to replenish bank capital and cut rates.”

In the last quarter, South Korea’s economy grew 2.3%, the fastest pace in nearly six years, marking a significant turnaround from the 5% contraction recorded in the fourth quarter of 2008. Still, “South Korea’s economy will shrink 1.8 percent this year, the IMF said yesterday, revising a July prediction for a 3 percent contraction.” Exports, which account for 50% of GDP, have also recovered, and are now rising by nearly 20% on an annualized basis. Retail sales are climbing, and bank lending to households has risen for six straight months. Finally, “Stimulus measures at home and abroad are fueling South Korea’s revival. The government has pledged more than 67 trillion won ($53 billion) in extra spending, helping consumer confidence climb to the highest in almost two years in June.”

However, an inflow of speculative hot money – which has buttressed a rally in Korean stocks – threatens to undo the recovery. “With an anticipated increase in risk appetite, foreign investors may invest further in emerging-market equities, leading to more dollar supply,” said one analyst. The first half 2009 current account surplus set a record, with forecasts for the second half not far behind. Korea’s foreign exchange reserves, meanwhile, have recovered, and could touch $300 Billion within the next year.

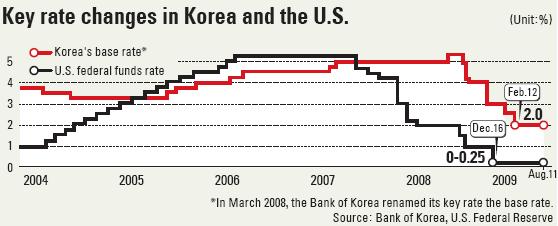

Of course, the Central bank is not simply standing by idly. It has already lowered its benchmark rate to a record low 2%, and at yesterday’s monthly monetary policy meeting, it firmly refused to consider raising it for at least six months. Commented one analyst, “There is no urgent need to raise rates. The most likely course of action is that the Bank of Korea will wait until the economy fully recovers, and in particular, they will wait until the unemployment rate stops increasing.” Still, given both that interest rates remain above levels in the west (see chart below) and that the Korean Won is considered undervalued, funds could continue to flow in.

The Central Bank’s other tool is direct intervention in the forex markets, in order to depress the strengthening Won. But this, it is loathe to do: ” ‘It would be better to have a larger foreign exchange reserve in order to better deal with economic crises, but attempts to buy dollars to artificially boost the reserve volume could lead to accusations of currency manipulation, while excess won in the markets could stoke inflation,’ a high-ranking ministry official said.” Still, investors are growing increasingly nervous about this possibility:”A state-run bank that usually doesn’t participate much in the market bought some dollars at the day’s low, prompting speculation about a possible intervention, a local bank trader said.” Sure enough, after hitting the psychologically important level of 1,220 at the end of July, the Won dived. It has yet to bounce back.

Fed to Hold Rates for the Near Term

Over the last week, the markets have been abuzz with chatter about how the US recession will soon come to and end, followed by a quick and healthy recovery. According to investor logic, the result would be a rise in inflation and interest rates. This optimism was partially deflated today, as the Federal Reserve bank conducted its annual monetary policy meeting.

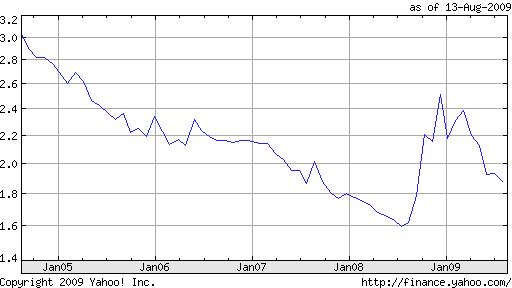

Excluding a brief uptick in June (see chart below courtesy of the Cleveland Fed), investors had long come to expect that the Fed would leave its benchmark Federal Funds rate unchanged, at 0-.25%. At the same time, there was a strong belief that the Fed would begin to hike rates at the end of 2009, and comment accordingly in the press release that accompanied its monetary policy decision. Barron’s predicted yesterday: “The statement will acknowledge some improvement in the U.S. economy, though it will imply that this nascent growth reflected in recent gross domestic product reports is fragile and will be monitored closely. This will leave open the specter that interest rates could be increased at some point in the future.”

Sure enough, the Fed left rates unchanged, and its press release conveyed a restrained sense of hope that the worst of the recession is now behind us: “Information received since the Federal Open Market Committee met in June suggests that economic activity is leveling out. Conditions in financial markets have improved further in recent weeks…Although economic activity is likely to remain weak for a time, the Committee continues to anticipate…a gradual resumption of sustainable economic growth in a context of price stability.” The Fed also announced that its Treasury buying activities would soon come to an end, although it may continue to buy mortgage securities as part of its quantitative easing program.

Perhaps the tone of the press release was slightly less positive than investors would have liked, since interest rate futures dived immediately on the news. Especially compared to last week, investors are now assuming that it will be a while before the Fed actually hike rates: “At Wednesday’s settlement price of 99.655, the February fed-funds futures contract priced in about a 38% chance for a 0.5% funds rate after the late-January meeting. That’s down sharply from about a 60% chance at Tuesday’s settlement, about a 76% chance at Monday’s settlement, and about a 96% chance at last Friday’s settlement.” Analysis of options trading activity reveals that the large brokerage houses believe similarly.

As for the Dollar, it now seems possible that last week’s rally was premature. If the Fed isn’t prepared to hike rates anytime soon, then the current interest rate differentials between the US and the rest of the world will remain intact. More importantly, the Dollar will remain a viable funding currency for carry trades, and the shift of funds into higher-yielding alternatives will probably continue for the time being.

British Pound due for Correction, Thanks to BOE

The British Pound’s rise since the beginning of March has been nothing short of spectacular: “Improving economic data have helped the pound advance 14 percent against the dollar this year and 12 percent against the euro.” Due primarily to a recovery in risk appetite and the concomitant belief that the Pound had been oversold following the onset of the credit crisis, investors began pouring hot money back into the UK. As recently as two weeks ago, one analyst intoned that, “Longer term, we are in part of an uptrend for the pound. I don’t think this is over.”

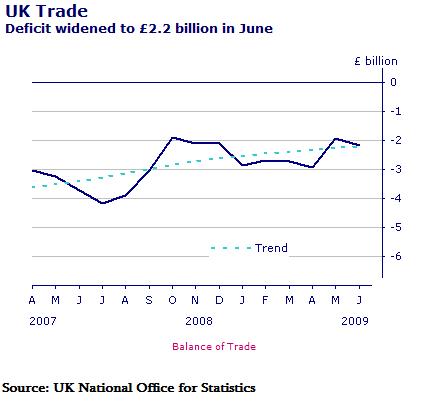

Since then, however, a series of negative developments have cast doubt on such optimism. The first was the release of economic data, which indicated an unexpected widening in Britain’s trade deficit. While exports rose, imports rose even faster, causing analysts to wonder whether it would be realistic to expect the British economic recovery would be led by exports: “We remain skeptical that the U.K. is about to become an export-driven economy any time soon. A return to sustained growth continues to look unlikely in the near term,” said one economist.

The second development was the decision by the Bank of England to expand its quantitative easing program: “The central bank spent 125 billion pounds since March as part of the asset-purchase program and had permission to use as much as 150 billion pounds, about 10 percent of Britain’s gross domestic product. Chancellor of the Exchequer Alistair Darling has now authorized an extra 25 billion pounds.” This came as a huge shock to investors, which had collectively assumed that the program had already been concluded.

Upon closer analysis, it appears that the rise of the Pound and the expanding trade deficit might have contributed to the BOE’s decision: “According to the Bank’s rule of thumb, this [the Pound's rise] is equivalent to interest rate increases of 1.5 percentage points.” However, interest rates are already close to zero. The BOE has already conveyed its intention to maintain an easy monetary policy for the near-term (March 2010 interest rate futures reflect an expectation for a 75 basis point rate hike); otherwise, there is nothing else it could do on the interest rate front. “Unless the UK is ready to deflate its production costs heavily, it can only achieve required competitiveness by reducing the value of sterling…The BoE knows this and its decision to increase its quantitative easing efforts may well have to be seen in the context of summer sterling strength.”

The final factor has been the Dollar’s sudden reversal. Previously, the Pound had been helped as much by UK optimism as by Dollar pessimism. This changed last week, when positive US economic data triggered expectations of a near-term economic recovery and consequent Fed rate hikes. In short, the Pound must now rest on its own two feet, and can no longer count on Dollar pessimism for a boost: “The current gloomy sentiment, which has chipped some 3% off sterling’s value against the dollar in the past four trading days, represents a sharp turnaround.”

The prognosis for UK economic recovery should receive some clarity tomorrow, when the Bank of England releases a report on inflation and GDP. At this point, we will have a better idea as to what to expect from the Pound going forward.

Dollar Reverses Course

A recent WSJ headline reads, Good Economic News Threatens the Dollar, and summarizes the Dollar’s trading pattern as follows: “Demand for the U.S. currency continues to erode amid a tide of more encouraging economic data and corporate earnings that have fed a thirst for riskier assets such as stocks, commodities, and growth-sensitive currencies.”

Less than two weeks after that article was published, the Dollar rose by a healthy 2% against the Euro in only one trading session, as US labor market conditions improved slightly: “The U.S. unemployment rate fell in July for the first time in 15 months as employers cut far fewer jobs than expected, giving the clearest indication yet that the economy was turning around from a deep recession.” While technically another 250,000 jobs were lost and economists forecast that the employment rate will rise past 10% before peaking, investor sentiment is still at a high.

Unsurprisingly, the news triggered a stock market rally. More noteworthy, though, is that the Dollar also rallied. Since the beginning of 2009 and especially since the beginning of March, there has been a clear negative correlation between stocks and the Dollar, as a result of risk appetite. “At one point this year, the correlation between the euro-dollar rate and the S&P 500 index hit 50 percent, according to BNP Paribas calculations. That is, the euro and S&P 500 rose or fell in tandem half the time.”

This latest development suggests that this relationship has broken down, at least temporarily. Argues one analyst, “The dollar’s going to turn. The U.S. economy is more able to withstand shocks than other economies, especially Europe.” Perhaps going forward, the markets will be driven less by risk appetite and more by comparative growth trajectories and economic fundamentals.

Not so fast, though. Much of the Dollar’s recent slide has been a product carry trading patterns, as investors borrow in low-yielding Dollars and invest in higher-yielding alternatives. An improvement in economic conditions could compel the Fed to hike rates, which would seriously dent the attractiveness of the carry trade. “Indeed, long-dated U.S. interest rates have been quietly moving in the dollar’s favor while U.S. interest rate futures on Friday started pricing in a federal funds rate of 1.25 percent by the mid-2010, the highest since June.” Based on this paradigm, then, it’s still risk appetite that’s driving the Dollar, whether up or down.

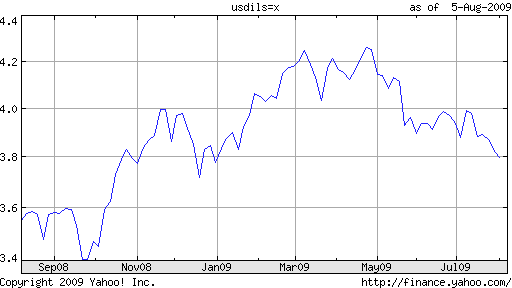

Bank of Israel Steps up Intervention on Shekel

Over the last year, Israel has quietly amassed one of the world’s largest repositories of foreign exchange reserves. On average, the Central Bank of Israel has purchased $100 million worth of Dollars every day since July 2008, bringing its total reserves to $52 Billion. The Bank’s goals are twofold: to sterilize the inflow of speculative money pouring into Israel in order to mitigate inflation, and to stem the appreciation of the Shekel.

Towards this latter, the Bank received a boost by the credit crisis, which caused an outbreak of risk aversion and sent investors rushing to shift funds into so-called safe haven countries/currencies. As a result, the Israeli stock market tanked, and the Shekel plummeted 30% in a matter of months.

Thanks to the recent upswing in risk appetite, however, the Shekel has bounced back, having risen 10% since April. While the Shekel still remains well off its its 2008 highs, the sudden rise still elicited the attention of the Bank of Israel, which announced that it would respond to the, “Unusual movements in the exchange rate that are inconsistent with underlying economic conditions, or when conditions in the foreign exchange market are disorderly,” by intervening heavily in the open market. It “is believed to have purchased between $1.5-1.7 billion this week so far.”

The Bank has also taken steps to inadvertently degrade its currency by lowering its benchmark interest rate to .5%, and buying bonds on the open market. “The central bank will have bought a total of 18 billion shekels ($4.7 billion) of bonds when it completes the program….The bank said in its statement that it does not intend to sell the securities it purchased and will continue buying foreign currency.” While its unclear whether the program has succeeded in stimulating the economy – which contracted by 3.7% last quarter – it has provoked inflation, which is still running in excess of 3% per year.

The forex markets have taken notice of both developments, sending the Shekel down 4% since Monday. Still, it’s not clear whether the Bank of Israel has any real credibility with traders. By its own admission, its intervention program is temporary: “It is clear that we won’t carry on buying foreign currency forever. Everybody understands that the central bank can’t beat the market, but sometimes the market does things that are not justified.”

Analysts, meanwhile, insist that the Shekel’s appreciation is not unusual, and that the intervention runs counter to fundamentals. “[The] market pressures strengthening the shekel against the dollar, are, in fact, consistent with underlying economic conditions. Fundamental economic conditions favoring the revaluation of the shekel include the accumulation of a balance of payments credit of $4.3 billion over the past thee quarters.” These analysts, then, are more concerned about rising inflation then about the competitiveness of Israeli exports.

Barclays, an investment bank, evidently subscribes to this school of though, and predicts the Shekel “will increase 2% after breaching their so-called resistance levels.” Merrill Lynch, meanwhile, sees the Shekel appreciating an additional 10% over the next year.

Yen Carry Trade is Back, but for How Long?

“Mrs Watanabe, the market’s metaphor for Japan’s housewife yen speculators, has come back to life.” In other words, the Yen carry trade is back. Precise data remains elusive, as always, but several recent papers/articles have nonetheless succeeded in bringing some clarity to this growing, but murky, type of trading strategy. According to one source, “Monthly capital and financial account outflow rose to a nine-year high of ¥3.75 trillion in March, up from ¥1.93tn in February, according to Japan’s Ministry of Finance. Similarly, Japan’s Investment Trusts Association reported last week that Japanese investment trust holdings of foreign assets surged by ¥1.77tn ($15bn) in April to ¥32.3tn and are now up ¥4.57tn year-to-date. This is the biggest monthly increase since the monthly data began in 1989.”

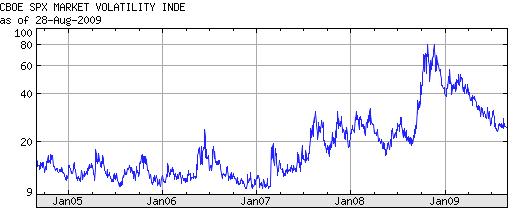

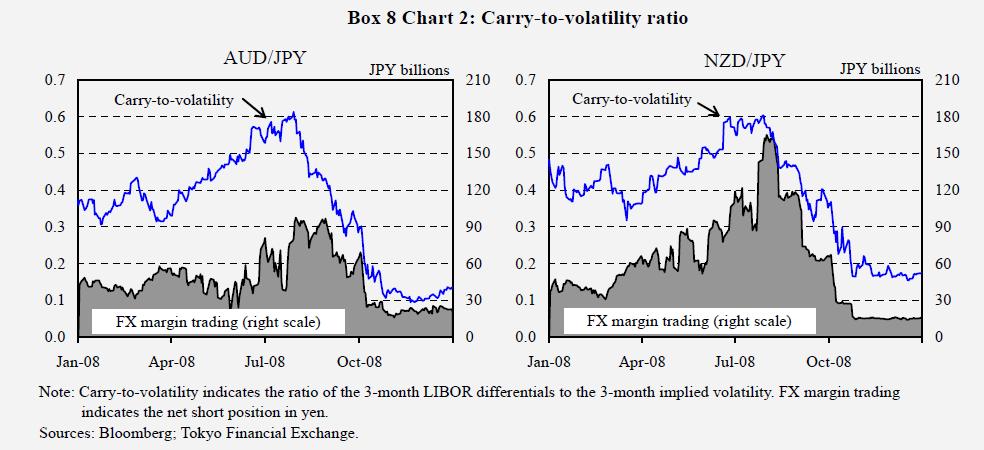

If it’s not already clear, allow me to spell it out. Japanese investors are collectively shorting their own currency, based on the expectation that it will neither appreciate suddenly nor fluctuate wildly so that they can earn profits from investing in higher-yielding alternatives. Research has showed (backed by common sense) that volatility is the main enemy of the carry trade. “When the carry-to-volatility ratio (i.e.,the ratio of the interest rate differentials to the volatility in the two currencies) increased through summer 2008 — in other words, when investors were able to make returns from the interest rate differentials under the low FX rate risk — they increased their positions to a remarkable degree.” On the flipside, “The reaction of the Japanese retail investors to the increase in financial market volatility (the VIX index measure of US equity market volatility is used as a proxy) was particularly apparent in October 2008 when investor positions were wound back sharply.”

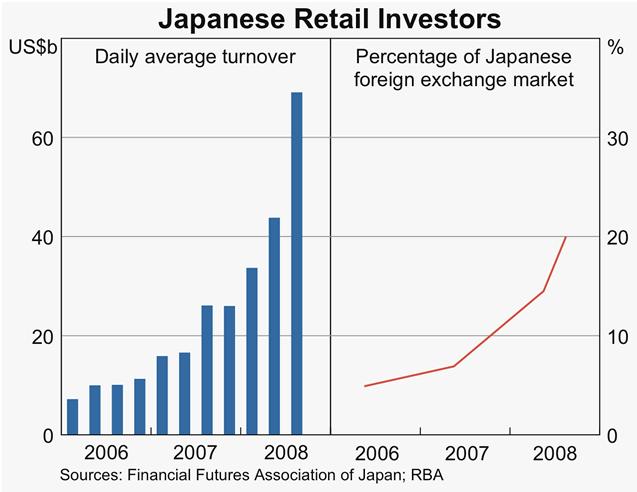

A pickup in risk appetite over the last few months, however, has brought about a decline in volatility. “Implied volatility on seven major currencies has fallen to 13.8 percent from a peak of 26.6 percent in October…from an average of 15.4 percent over the past year.” As a result, Japanese investors have rushed back into the market. The total number of forex margin accounts in Japan is estimated to have increased 50% over the last year, with account balances rising by 30%. In 2008, Japanese retail investors already accounted for 20% of daily turnover in the Japanese Spot Forex market. When you consider these growth rates, this figure is probably even higher now.

There is evidence, however, that such investors are shifting their trading strategy. Prior to the credit crisis, the data shows that they “Increased their foreign currency net long positions when the investment currency depreciated and reduced these positions when the investment currency appreciated. This behaviour is consistent with realising returns by selling positions when the investment currency appreciates and adding to positions when the investing currency depreciates.” Now, however, they have taken to copying “professional” speculators, who tend to swing trade short-term changes in momentum.

As for which currencies represent the most popular targets for carry trades, investors typically buy those currencies that are less volatile and higher-yielding. “The favorite bet is for the Australian dollar to strengthen versus the yen. Wagers on the Aussie more than tripled to 64,293 contracts in the five weeks to April 27, while those on the kiwi — named after a flightless bird native to New Zealand and depicted on the one dollar coin — rose to 36,454.” The Euro is in a distant third.

Perhaps in response to this pickup in carry trade activity, the Bank of Japan is finally clamping down. Rather than raise interest rates – which could harm the prospects for economic recovery – it will require Japanese brokerages to lower margin rates by 2010, to 25 x collateral. Still, logic (and legislation) doesn’t rule, when it comes to forex. ” According to a Federal Reserve Bank paper, “The currencies of countries with low interest rates have tended to depreciate, or to not appreciate sufficiently to offset arbitrage opportunities.” For now at least, it likes like the carry trade is still safe.

The US Housing Market and the Dollar

As reported today by the Mortgage Calculator and other sources, the US housing market could be in the early stages of recovery. “Nationwide, home resales in June are up 9 percent from January, on a seasonally adjusted basis. Sales of new homes have climbed 17 percent during the same period. And construction, while still anemic, has risen almost 20 percent since the beginning of the year. Even home prices, down one third from the top, edged up in May, the first monthly increase since June 2006.” While the data is certainly susceptible to overly optimistic interpretation, these represent positive developments by any standard.

Before I lose the forex traders out there who probably think that they logged on to a housing blog by mistake, I’d like to point out that the release of this data coincided with a marked decline in the value of the Dollar, which “hovered near its 2009 low against the euro on Tuesday as a surprisingly strong U.S. housing report suggested the recession was waning.” This sound-byte encapsulates two important relationships: between forex and housing, and between housing and the economy. The former is indirect, while the latter represents a direct connection.

In a vacuum, forex traders probably couldn’t care less about housing data. Between interest rates, economic performance, geopolitics, risk appetite, financial markets, there is enough fodder to overwhelm most amateur analysts. Housing, then, is only important insofar as it bears on one of these “primary” forex factors. However, given the increasing role of housing in the US economy, perhaps it should itself be elevated to the top tier.

Let me explain: when the positive housing data was released last week, financial markets rallied, led by a “4.5% leap in the Dow Jones U.S. Home Construction Total Stock Market Index.” This immediately carried over into forex markets, as investors sold the Dollar en masse. “The market was desperate looking for direction, and a number like this is giving the market a small lift,” offered one analyst.

“The dollar remains vulnerable to good economic news,” summarized another. At face value, it might seem somewhat ironic that the Dollar is now inversely related to US economic performance. From the collective standpoint of investors, the US economic recovery is simultaneously indicative of and less interesting than a global recovery, and an improved environment for risk-taking. This tends to manifest itself in the form of a shift of funds away from safe-haven currencies is riskiery alternatives. In short, pay attention to the US housing market (data); the Dollar hangs in the balance.

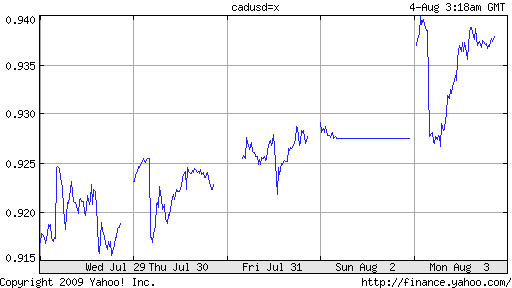

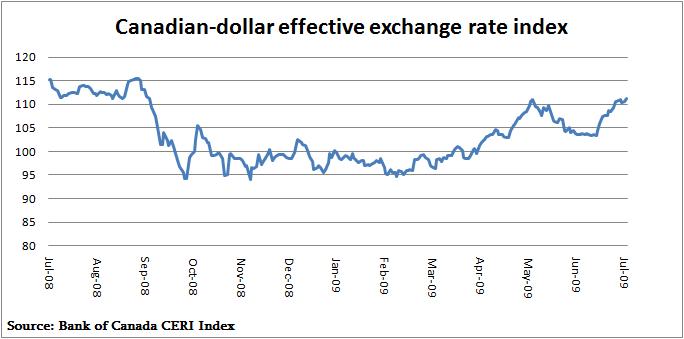

Canadian Dollar Volatility could Spur Intervention

Since the Forex Blog last covered the Canadian Dollar – on July 29 – the Canadian Dollar appreciated another 2% against the US Dollar, reinforcing the perception that the currency is both too volatile and appreciating too rapidly. This concern is harbored by the Central Bank officials and policymakers, which fear that the rising currency represents the proverbial wrench in the Canadian economic recovery.

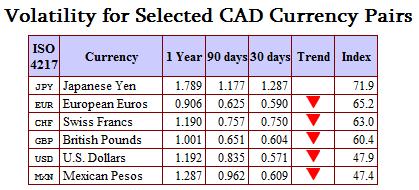

From a volatility standpoint, it looks like their concerns are justified. “For years it was traditional for the cost of a one-week option on the Canadian dollar to be 20 to 25 basis points…The cost is now commonly in the 50-point to 75-point range and in the last six months it has been as high as 100 points.” On a relative basis, the currency is also more volatile than the commodities with which it is commonly associated. In the last two months alone, it recorded both a 7.4% plunge and a 10% rise. To be fair, short-term volatility is lower than it was one year ago, but this isn’t going to placate those who insist that it’s still too high.

Looking at the charge that the Canadian Dollar has risen too rapidly, this too appears valid. One could argue that the thundering 20%+ rise since March was simply a retracement (in FX terminology), necessary to offset the even bigger decline that took place following the onset of the credit crisis. This argument, however, ignores the notion that the Loonie was probably overvalued before it fell. At that time, commodity prices were sky-high, and expectations were that they would remain high, if not soar even higher. Since then, they have fallen precipitously, to less than half of the record highs recorded during the peak of the bubble.

Speaking of commodity prices, “At the time of its [the Bank of Canada's] last statement, oil prices were about $75 a barrel, but now they are in the $60-to-$65 range. That suggests the currency’s appreciation has outpaced the demand for its commodity exports.” In other words, the Loonie’s recent rise can be attributed more to speculation, than to a change in fundamentals. “The rise in the dollar reflects ‘hot money seeking alternatives to the greenback,’ not the underlying economic strength,” agrees one analyst.

The Bank of Canada, naturally, views this as a problem, and “Bank of Canada Governor Mark Carney says he is prepared to intervene in currency markets if the Canadian dollar’s rise persists and threatens to smother the ‘nascent’ recovery. If not for the uncertainty surrounding the Loonie, in fact, BOC officials are quite confident that Canada’s economy would grow consistently in the near-term.

The Central Bank’s options are limited, since its main policy rate is already close to zero. This can still be tweaked, explains one analyst. “If you thought you were going to tighten in the first half of 2010 and the currency shoots to parity at some point, maybe that means you don’t get there until the end of 2010.” The bank’s only other monetary policy option is qualitative easing (i.e. printing money), which at this point in the cycle, seems unlikely. “Intervening in currency markets to quell the Canadian dollar’s strength is also an unattractive option for the bank, which views intervention without accompanying monetary policy action as ineffective. That leaves commenting on the currency as the only really agreeable option for the bank.” However, given that the Loonie has continued to appreciate in spite of Carney’s warnings, it seems traders have disregarded these threats as mere idle talk. To parity we go!

London Session - September 7, 2009 6:51 AM

Asia Session - September 7, 2009 1:29 AM

Dollar makes move but what’s that really mean for the US Economy?

Non-farm payrolls in the U.S. was to the downside….

Click here to read the entire article in the Wall Street Journal09/06/2009 - The USD bounces back from the brink

* Still looking for risk aversion to dominate

* Long-term CAD fundamentals positive

* G-20 likely to see more talk than action

* Bank of England set to stay cautious

* German export data should show signs of improvement

We look for the inter-market correlations that have prevailed throughout 2009 but broke down into the latter part of the summer to resume. We’ve seen some of this in the first week of September, with higher EUR correlating with higher stocks and commodity currencies. The market seems to be in the process of putting in a short-term top as better than expected economic data of late have failed to elicit any material extension in equities. The more than 50% rally off the lows in the S&P is unsustainable in our view and we would expect a China-like correction in US stocks in the weeks ahead. Full text »

Will the U.S. Dollar Hold Its Gains?

Forex trading forecast for the greenback

One of the questions being asked right now has to do with whether or not the U.S. dollar can hold its recent gains. Many are wondering what today’s unemployment rate report — showing 9.7% unemployment — means for the forex trading forecast.

For the dollar, it may not be that bad. And it may not even mean that things are going that badly for the labor market. GFT’s Kathy Lien looks, in FX360, at what the latest payroll numbers may mean for the U.S. dollar in currency trading:

However there is no question that the trajectory of payrolls has improved, which has brought relief to the currency market and helped the dollar recovered its gains after traders realized that the report was not that bad. With the initial post payroll volatility settling and the holiday weekend looming, the dollar should hold onto its gains.

London Session - September 4, 2009 5:32 AM

Asia Session - September 3, 2009 10:28 PM

CNN Quotes Kathy Lien

As Gold reaches close to ,000 an ounce, what does it mean?

The price of gold is nearing ,000 an ounce. Does this mean inflation? Does it mean another financial collapse?

Well, it closed at 7.70 Thursday, up .20 from Wednesday.

Find out what Kathy thinks and its affect on the U.S. dollar and other major currencies.

What Makes Prices Move?

Today I will go over what I think drives price movement in the markets, why I hold these beliefs, and why I think it is important to understand the forces in price movement.

The reality is that the only force that moves prices in any market is the buying and selling of the financial instrument. For our purposes, we will use currency trading as an example, but this is true in all liquid, openly traded markets. Currency prices don’t fluctuate on their own. They only move up when traders are willing to buy at a price higher than the current price, and the only move down when traders are willing to sell at a lower price. That sounds incredibly simple, but this is a very important fact to establish.

Economic Recovery Could Be On The Way

Currency trading on the FX market

When deciding on a plan of action for currency trading on the FX market, it can be a good idea to consider the possibility of economic recovery. Right now, there is hope that economic recovery is on the way.

The economic data, especially today’s jobless claims, shows an improving picture. However, the economy is improving at a miniscule pace, and there is speculation that economic recovery will be something less than robust.

GFT’s Kathy Lien reports in FX360 on the Fed’s cautious optimism about the economic recovery:

As for the economy, the Fed sees signs of stabilization. Housing activity and motor vehicle sales are improving while overall consumer spending is leveling out. The recovery is expected to gain momentum in 2010 but consumer demand will still be constrained by reduced household wealth. Although the Fed is more confident that the recovery is underway, the strength of the recovery is still uncertain. Even within the central bank, there is a disagreement about the pace of the upturn because of tight credit and the risk of adverse shocks.

These signs of stabilization are also leading to some changes in currency trading on the FX market. Risk appetite is slowly making a comeback, and the euro and sterling are higher today.

Central Banks’ Mandates Expand to Include Asset Price Stability

There was never much doubt about the underlying causes of the credit crisis. Basically, combination of low interest rates and lax regulation fueled a leveraged credit expansion, which exploded spectacularly last fall. The main issue has always been how to ensure such a crisis doesn’t ever happen again- at least not on the same scale. Towards that end, policymakers around the world have been busy over the last few months conducting hearings and soliciting expert testimony, and are now close to passing sweeping overhauls of their countries’ respective financial systems.

Well, maybe sweeping is too strong of a characterization. In any event, big changes are underway. The US government is leading the way, in attempting to strip the Federal Reserve Bank of its power to regulate consumer finance, but is compensating the Fed by handing it the authority to “oversee large financial institutions…The overhaul would also give the Fed a seat on a new council charged with guarding against financial-market meltdowns like the one that hit the banking system last year.”

Another bill that is currently working its way through Congress would enable the “Government Accountability Office to ‘audit’ the Fed’s decisions on monetary policy.” It’s unclear what exactly that would entail, but at the very least, it would remove some of the Fed’s independence. Already, the Fed is making an effort to increase its transparency, by expanding its interactions with the public beyond the “brief, cryptic statements that analysts busily decode in the days that follow” monetary policy decisions.

The most significant change, especially as far as currency traders and interest rate watchers are concerned, is the potential expansion of the Fed’s mandate, which is currently to “promote ‘full’ employment…while maintaining ‘reasonable’ price stability.” Future monetary policy, however, could be conducted with broader aims: “The Federal Reserve seems to be volunteering to be top bubble burster. In a recent speech, Bill Dudley, the president of the Federal Reserve Bank of New York, overturned more than a decade of Fed orthodoxy by claiming it was the central bank’s duty to defuse asset price bombs before they detonate.” While this declaration has earned plaudits from some economists, it comes with the caveat that asset bubbles could be difficult to identify and even more difficult to defuse. One has proposed that “Regulators develop a small set of measures of irrationality that can be calculated and published at least monthly,” but it seems unlikely that this will be implemented anytime soon.